Power Sector Reforms: The Push for Discom Privatization

A Deep Dive into the Ailing Power Distribution Sector and the Move Towards Privatization

This edition focuses on a critical aspect of India's economic reforms: the privatization of power distribution companies, or discoms. We'll explore why these state-run entities are bleeding financially, the government's rationale for privatization, the significant developments in Uttar Pradesh – home to one of the country's largest privatization efforts – and the hurdles that lie ahead.

The Bleeding Balance Sheets: Why Discoms Are in the Red

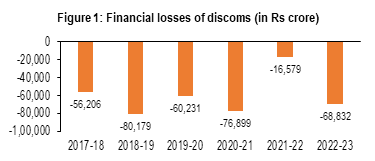

India’s electricity distribution companies (discoms) have long been the weakest link in the power sector. Despite reforms, discoms continue to post mounting losses—rising by 81% and debt up by 62% since 2015-16.

Ongoing fiscal strain, mounting borrowings, and state-backed assurances remain a threat to the fiscal health of state governments. These represent off-balance-sheet obligations — if a power distribution company defaults, the financial burden ultimately falls on the state, essentially taxpayers.

There are several reasons behind it:

High Aggregate Technical & Commercial (AT&C) Losses: These losses, a combination of energy loss during transmission and theft, as well as inefficiencies in billing and collection, are a significant drain. While there has been some improvement, with national average AT&C losses for state-run discoms falling from 23% to 17% by the end of 2023, they remain high compared to the single-digit losses of private discoms.

Non-Cost Reflective Tariffs: Political pressure often keeps electricity tariffs for certain consumer segments, particularly agricultural and domestic, below the actual cost of supply. This gap between the average cost of supply (ACS) and average revenue realized (ARR) is a major contributor to losses. Moreover, state subsidies to fund this gap are often delayed or insufficient, worsening cash flows of discoms.

Inefficient Power Procurement: Discoms are often locked into expensive and long-term power purchase agreements (PPAs), leading to high procurement costs. In some cases, they are contractually obligated to pay generation companies even without purchasing any electricity.

Operational Inefficiency: Public sector management and political interference

have led to poor recovery rates and mounting debts.

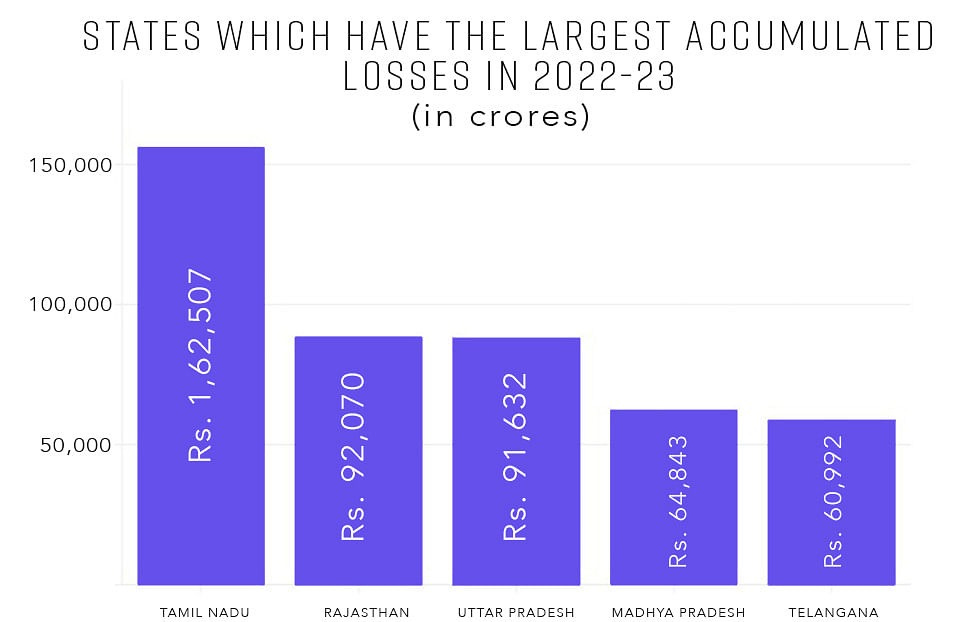

The gap between the average cost of supply (ACS) and the average revenue realization (ARR) per unit of power sold by state-owned discoms remains high at 73 paise per unit in FY2023. The gap is significantly above the national average in states like Uttar Pradesh, Maharashtra, Telangana, and Tamil Nadu. To bridge this gap, tariff hikes ranging from 12% to 25% are required.

These factors have made state-run discoms financially unsustainable due to Cost-Revenue Mismatch, which has prompted calls for reform and privatization.

The Case for Privatization

Faced with the mounting financial burden, the government has been advocating for privatization as a key reform. The success stories of privatization in Delhi, and more recently in Odisha, have provided a template for other states.

Privatization is seen as a solution to inject efficiency, capital, and modern management into the sector. The contrast in financial performance between state-run and private discoms is stark:

Profitability of Private Players:

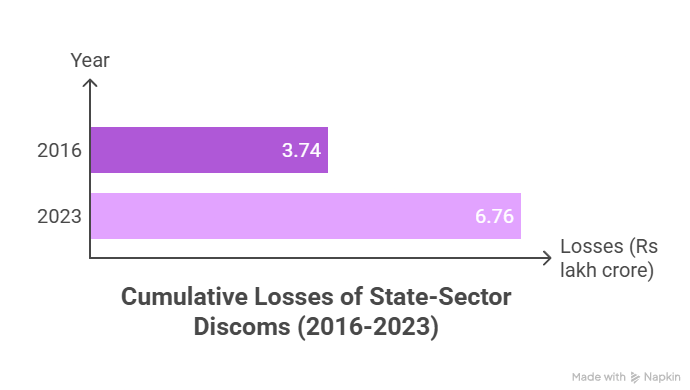

While the losses of the state-sector discoms increased from Rs 3.74 lakh crore in 2016 to Rs 6.76 lakh crore in 2023, the private-sector discoms went from Rs 2,048 crore losses as of March 2016 to Rs 28,769 crore profit of March 2023.Tata Power Delhi reduced AT&C losses from 53% (pre-privatization) to 7.25% by FY23, achieving consistent profitability. Torrent Power and CESC have also maintained profitability through efficient operations and lower losses.

AT&C Loss Reduction:

While private discoms still face AT&C losses, they are far lower than state-run counterparts.Private discoms consistently maintain AT&C losses below 10%, except in newly privatized regions. State discoms have higher and more variable losses, often exceeding 15–20% in several states (average AT&C losses for state discoms ~ 17% in FY24)

Debt Management:

Private discoms carry ₹23,116 crore debt (FY23) versus ₹6.8 lakh crore for state discoms. Their debt is serviceable due to revenue efficiency.

The UP Discom Privatization: India’s Largest Attempt

Uttar Pradesh is moving ahead with what could be the country’s largest discom privatization, targeting Purvanchal Vidyut Vitran Nigam Ltd (PUVVNL) and Dakshinanchal Vidyut Vitran Nigam Ltd (DVVNL), which together cover 42 of UP’s 75 districts and have a combined annual revenue of >₹40,000 crore.

Stake Sale: The UP government will sell a 51% controlling stake in each discom, retaining 49%.

Major Bidders: Top Indian power companies—Adani Group, Tata Power, Greenko, Serentica Renewables, Torrent Power, ReNew, CESC, and a GMR-EDF consortium—have shown interest.

Process & Timeline: Grant Thornton Bharat LLP is advising the transaction. The RFP is expected by July, with completion targeted around Deepawali 2025.

Expected Outcomes: The move is expected to bring in private sector efficiency, reduce losses, and improve service delivery.

Challenges Ahead

Despite the promise, privatization faces significant hurdles:

Employee Resistance: Over 2.7 million power sector workers have protested, fearing layoffs, loss of benefits, and job insecurity.

Political and Legal Pushback: Privatization is a politically sensitive issue, with concerns about tariff hikes and service to rural/poor consumers. Legal challenges could delay or derail the process.

Financial Viability: Discoms carry heavy debts and unfunded pension liabilities. Private investors are wary of inheriting these burdens without a clear path to cost recovery and operational improvement.

Transition Management: Past experiences (Odisha, Delhi) show that success depends on realistic loss reduction targets, transitional subsidy support, and transparent asset valuation.

The successful privatization of the UP discoms will depend on the government's ability to navigate these complex challenges through a combination of a well-structured bidding process, a robust regulatory framework, and effective stakeholder management.

The outcome of this mega-deal will not only determine the future of Uttar Pradesh's power sector but will also serve as a crucial test case for the broader discom privatization agenda in India.